When Warren Buffet made profit on silver

This is a story of past silver purchase that cornered Comex participants. Between 1997 – 1998, Warren Buffett purchased 4.000 t. in weight of silver, which eventually had been sold by 2006. And as kind reader might expect, there is more behind a story than often is being considered as simple purchase-hold-sell transaction.

Dramatis Personae

Warren Buffett – American investor and philanthropist, chairman and CEO of Berkshire Hathaway. As a result of his long-term strategy investment success, Mr. Buffett is one of the best-known investors in the world. As per 2024, his net worth is being estimated to be at approx. 150 bln USD. Value investor, whose biography slowly starts to resemble hagiography of a living saint.

Charles Munger – Businessman, investor, and philanthropist. Vice chairman of Berkshire Hathaway from 1978 until his death in 2023. Warren Buffett described Mr. Munger as his closest partner and right-hand man, and credited him with being the "architect" of modern Berkshire Hathaway's business philosophy.

Silver short traders on Comex. Without whom scheme as described below wouldn’t be possible.

Act One – The Purchase

In 1997, Berkshire Hathaway made a significant investment decision by acquiring 111.2 mln ounces of silver. Such volume would be nearly 3.5k t. of white metal. Later, in further tranche additional volumes had been acquired, which increased total volumes to 129.7 mln ounces. With price increase that occurred at a time, Wall Street Journal from 9th Feb 1998 mentioned nearly 1 bln USD of silver in value. Capital investment was 650 mln USD. Yet even this figure was still slightly below 2% of Berkshire Hathaway’s overall portfolio. Berkshire’s Hathaway market cap at the end of 1997 was at 57 bln. And at a time, it was said that if the price of Coca Cola shares had dropped 5 USD at the time, it would have been a more significant loss to them than if silver went to zero-dollar value.

Silver purchases by Berkshire Hathaway occurred in a period commencing 25th July 1997 and ended on 12th in January 1998. How do we know that? Following 1997 annual letter to investors, dated on 27th February 1998 - Warren Buffet himself mentioned 111.2 mln ounces acquired in 1997. We’ll refer to this source later in the text. Remaining 18.5 mln ounces had been purchased on 12th in January 1998. Which finds further confirmation in Berkshire Hathaway’s press release dated 3rd February 1998.

Purchases were spread out in a period of time, to minimize risk that amassing of purchases would adversely affect price against Mr. Buffet’s investment. And so, within approx. six months, Berkshire Hathaway became an owner of 129.7 mln ounces – that would be nearly 130k of 1000 oz Comex silver bars. Slightly over 4k t. Considering that 1 lot (minimum order) in Comex equals 5 of such bars (5000 ounces), we’re talking about equivalent of approx. 26k contracts.

But the truth is, although astonishing, above are still just a number. And without appropriate scale to compare to, they may remain meaningless. And scale we have:

• During second half 1997, Comex inventories fell from approx. 200 mln ounces to approx. 80 mln ounces in Q1 1998 and later to approx. 50 mln ounces at H2 1998. This is mostly attributable to Warren Buffet’s short stint in the silver market.

• Silver Institute states, 1997 silver supply stood at 863.4 mln ounces, including nearly 200 mln ounces hedged and marked as implied disinvestment.

Comex silver inventories with interesting to us period. Source: https://www.financialsense.com/contributors/steve-angelo/critical-factors-that-will-impact-silver

How to make such a purchase unseen? Accumulation of large quantities of silver occurred via Phibro, at a time a subsidiary of Salomon Brothers, an investment bank in which Berkshire Hathaway had a big stake, and which he had saved from extinction when its traders cornered the Two Year Treasury note market in 1991. In 1997 Salomon was acquired by Travelers Group - whose shareholders included Berkshire Hathaway holding company. Later, in 1998 it merged with Citicorp to form Citigroup.

Phibro’s role had been publicly known on 4th of February 1998, when company admitted it was them who were a broker in question. Day after Berkshire Hathaway issued press release, disclosing certain details of transaction, but without mentioning actual broker’s name. Funnily enough, just month earlier Lovell & Stewart, the law firm, filed a lawsuit against Phibro, alleging the company had manipulated prices in the silver market.

Establishing timeframes allows us to establish price range. Mid July 1997 marks local bottom at 4.14 USD End of next week Berkshire Hathaway commences purchases. Berkshire Hathaway’s silver purchases coincided with a 3.5-year price low. Local lows are at approx. 4.30 USD, then closure prices of November 1997 will be at 5.11 USD, December’s at 6.00 USD and January 1998 at 5.85 USD. Outlook from financial statements indicates to average price 5.05 USD for 1997 lot and 5.5 USD for 1998 lot.

Silver price mid-July 1998 (local bottom) up to mid-May 1998. Source: Tradingview

Was this price increase result of purchases made at a time? Most likely. inventories monitored at U.S. exchanges had dwindled significantly and traders guessed on why and who ships silver from New York to London, where warehouse stockpiles aren't disclosed.

This made Berkshire Hathaway one of the most significant institutional holders at a time and even in history. Just for comparison: famous / infamous Hunt Brothers hoarded between 1973-1980 a 100 million oz silver plus additional 100 million oz of backfiring paper silver leverage. In more contemporary times, JP Morgan amassed 153.7 mln silver ounces by the middle of 2019, as a result of purchases made since 2011.

Act Two – The Great Unfolding

Climate surrounding silver at a time wasn’t very supportive for such investment. Mr. Buffet’s purchases happened years after dramatic decline on silver market experienced in the 80’s, which saw price per ounce to drop from 50 USD tops to below 10 USD level. It was due to past events involving Hunt brothers, who had nearly monopolized the market in 1979, leading to a significant price growth and then sharp decline in silver prices in 1980. As a result of past events, white metal fell out of good graces and was considered risky speculation asset. And it didn’t matter it occurred nearly two decades earlier, as financial markets have long and good memory.

Normally, Berkshire Hathaway wouldn’t have to reveal on its silver acquisition, however, upon period of purchases being made, there were accusations on silver prices were being manipulated which led to Commodity Futures Trading Commission (CFTC) announcement that it was looking into them. Additionally, on 28th of January 1998, a class action lawsuit was filed against some of the commodities firms that had been buying the silver. Lawsuit maintained that price of silver was being manipulated because the price of silver was rising as gold was going down, which was considered an unprecedented occurrence.

Berkshire Hathaway press release from 3rd February 1998. Source: https://www.berkshirehathaway.com/news/feb03981.html. Letter in PDF version can be found at: https://www.berkshirehathaway.com/news/oldnews.html

To avoid being linked to the above by accidental timing, and to avoid being part of accusations, Berkshire Hathaway issued a press release on 3rd of February 1998, when it disclosed the purchases. And needless to say, that silver jumped higher on charts on the news, After all, it was ‘the Oracle of Omaha’ who made a purchase:

Because of recent price movements in the silver market and because Berkshire Hathaway has received inquiries about its ownership of the metal, the company is releasing certain information that it would normally have published next month in its annual report. (…)

The company owns 129,710,000 ounces of silver. Its first purchase was made on July 25, 1997 and its most recent purchase was made on January 12, 1998. (…)

All metal was purchased for London delivery through a single brokerage firm (Phibro – red.). No options have been or are held by Berkshire. No purchases have been made that established new highs for the metal and all buying has been after dips. Berkshire has had no knowledge of the actions or positions of any other market participant and today has no such knowledge.

Berkshire has no present plans for purchase or sale of silver (this statement could be used as confirmation of no further purchases beyond 12th Jan 1998 – red. ). The position at cost comprises less than 2% of the company's investment portfolio.

Warren Buffett and Charlie Munger in 2019. Source: https://apnews.com/article/warren-buffett-berkshire-hathaway-letter-charlie-munger-41d58fcfe54fa1eba8f5492aac0542a2

Few weeks later, in its 1997 annual letter to investors, dated on 27th February 1998 - Warren Buffet wrote on first tranche of above purchase as follows:

Our second non-traditional commitment is in silver. Last year, we purchased 111.2 million ounces. Marked to market, that position produced a pre-tax gain of $97.4 million for us in 1997. In a way, this is a return to the past for me: Thirty years ago, I bought silver because I anticipated its demonetization by the U.S. Government. Ever since, I have followed the metal's fundamentals but not owned it. In recent years, bullion inventories have fallen materially, and last summer Charlie (Munger – red.) and I concluded that a higher price would be needed to establish equilibrium between supply and demand. Inflation expectations, it should be noted, play no part in our calculation of silver's value.

Yes, within months since purchase, unrealised profit was 97.4 mln USD of 650 mln USD initial capital investment. And soon even more, as ‘stock’ (capital + profit), will be valued at nearly 1 bln USD.

Year later, on 1st of March 1999, in 1998 annual letter Mr. Buffet addressed subject of silver purchases again:

Last year I deviated from my standard practice of not disclosing our investments (other than those we are legally required to report) and told you about three unconventional investments we had made. There were several reasons behind that disclosure. First, questions about our silver position that we had received from regulatory authorities led us to believe that they wished us to publicly acknowledge this investment.

Act Three – The Development

Let’s wrap up the facts. In the middle of 1997, Berkshire Hathaway began buying Comex silver. It made it using Phibro as a broker. Purchased volume had been transferred to vaults in London. By mid-January 1998, an equivalent of 129.7 mln ounces had been accumulated in form of delivered stock and contracts maturing March 1998. This dragged down Comex inventories significantly. During first week of February 1998, Mr. Buffet announced instead of rolling over his maturing contracts into the future, he wanted physical stock, deliverable to London. Hence the press release dated 3rd of February, quoted before. But in said source, there is one more important paragraph on silver stock proportions, which we still have to invoke.

During 1998, Berkshire has accepted delivery of 87,510,000 ounces in accordance with the terms of the purchase contracts and the remaining contracts for 42,200,000 ounces call for delivery at varied dates until March 6, 1998. To date, all deliveries have been made on schedule. If any seller should have trouble making timely delivery, Berkshire is willing to defer delivery for a reasonable period upon payment of a modest fee.

There were no sufficient Comex inventories to cover physical deliveries of over 42 mln ounces expected by Berkshire Hathaway. This volume equalled slightly over 1.3 t. of white metal. Short-sellers were scrambling to find any available physical silver they could acquire. This affected the price. In mid-February, an ounce was at 7.30 USD - more than 60% increase from mid-1997. Prices of nearby contracts skyrocketed, relative to prices for delivery in spring. While May and July spread went up by approx. 0.20 USD, March contracts did up to 1.25 USD (20%!) within week.

Berkshire Hathaway of course clearly stated – as quoted above – willingness to defer deliveries for a fee. Unconfirmed rumours from that time claimed, owing to Berkshire Hathaway had to pay the fee of approx. 0.50 USD per ounce to get the extension of maturity. This however finds confirmation in calculations. Market rate for deferring delivery by a month was as high as 75% on an annualized basis. In dollar terms, about 0.45 USD (6% of the price) for a single ounce, just to defer delivery by one month.

So, as always in time of shortages, Comex turned their eyes towards bigger brother – London’s finest - LBMA. Exactly where Berkshire Hathaway asked deliveries to be made, and where it already had significant stock. And where of course, it was ready to lend silver with premium, to those having delivery obligations towards Berkshire Hathaway.

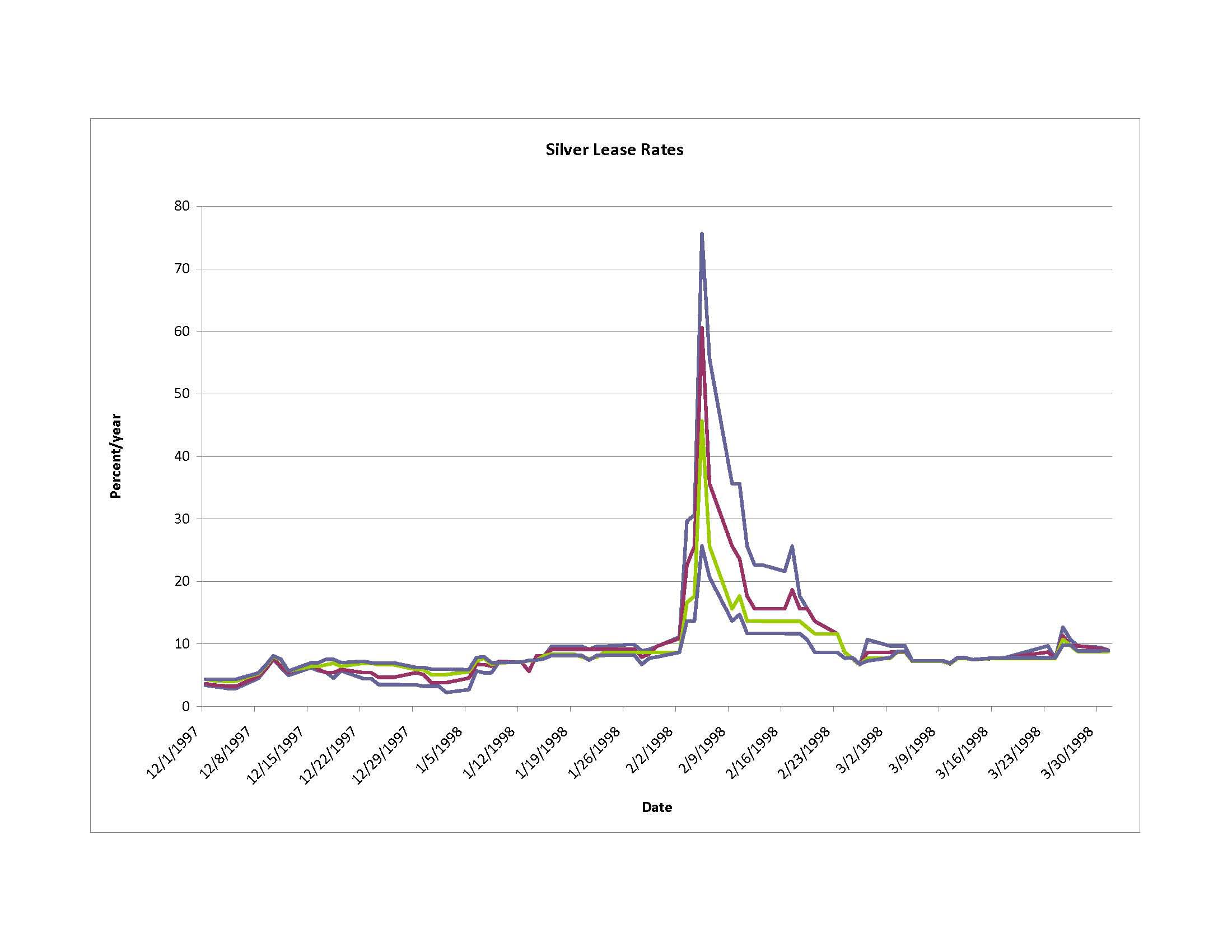

Signs of squeeze were clearly visible in London loco market as well. Short-term lease rates skyrocketed around the time of expected deliveries - in early February they reached 75% annualised, making entities having physical metal very happy, and those not having it, just the opposite. Lease rate is the cost of borrowing metal. If you need to borrow or lease silver in a hurry to make delivery, you are willing to pay a big premium for nearby delivery. Which simply means, you are willing to pay a lot to borrow/lease silver which you’d use to fulfil delivery obligations. Of course, will have to eventually repay lender with said metal.

London silver lease rates skyrocketed in February 1998 to over 75%, due to Warren Buffet’s silver scheme. Source: https://static.seekingalpha.com/uploads/2012/2/19/saupload_Silver-Lease-Rates1.jpg

This also had a ripple effect extending farer than just New York and London. Major buyers of silver like Eastman Kodak, which processed millions of ounces a year into camera films, faced big increases in raw-material costs. But even more interesting things were happening in India. Late autumn 1997 Indian market – usual, seasonal large buyer of silver from London, nearly stalled its imports. Reason lied in increase of prices. And upon prices of over 7 USD per ounce experienced with beginnings of 1998, inhabitants of this major importing country started to sell their silverware and jewellery en masse. In effect, this caused chokepoint in form of creating large backlogs processing silver flooding into London.

There was plenty of silver in New York, but Berkshire Hathaway didn’t want delivery to be made there, even though it was cheaper Instead, Hence, silver was being shipped from NY to London, by air freight, adding additional premium, where it had to be re-assayed because the assay marks were from a companies no longer in existence. This created yet another bottleneck.

In effect, if entity owed silver to Berkshire Hathaway, with all bottlenecks experienced, it was effectively forced to lend it from London (at a high premium) or defer delivery (again at a high premium).

Act Four – The Conclusion

So, let’s wrap up the facts. In the middle of 1997, Berkshire Hathaway began buying Comex silver. It made it using Phibro as a broker. Purchased volume had been transferred to vaults in London. By mid-January 1998, an equivalent of 129.7 mln ounces had been accumulated in form of delivered stock and contracts maturing March 1998. This dragged down Comex inventories significantly. During first week of February 1998, Mr. Buffet announced instead of rolling over his maturing contracts into the future, he wanted physical stock remaining of 42 mln oz, deliverable to London. This caused significant bottlenecks in silver processing and transporting at NY-London and India-London routes, which left market participants scrambling for silver and being effectively left with option to lend it from London (at a high premium) i.e. from Berkshire Hathaway itself or defer delivery (at a high premium).

Berkshire Hathaway earned premiums on lending its London silver to those in need, on agreeing for deferred deliveries of maturing contracts and on spot price itself. Although in general, market participants were surprised by the price moves in silver did not breakout even higher, as it moved from slightly above 4 USD level to approx. 7 USD price tag. Some investors were even convinced at a time, white metal would shoot up to 10 USD an ounce. But Berkshire Hathaway wasn't acquiring more silver. It made its last purchase on 12th Jan 1998. Without a big buyer of proportional size, price of white metal soon began to fall, but not until delivery commitments to Berkshire Hathaway’s indicated London vault concluded.

Comes silver prices and silver lease rates on LBMA.

Berkshire Hathaway made a substantial profit on silver of its 650 mln USD capital investment, netted in 2006 at approx. 275 million USD. During the year of disposal (by 2006), spot price per ounce was at lows of 8.71 and heights 15.29 USD.

Critics (like William L. Silber in his book ‘The story of Silver’) emphasize, that 275 mln USD yields equals about 5% per year, which is less than if the same money had been placed in US Treasury bonds. And, if Buffet had waited any longer, in September 2011, an ounce of silver was at 44.92 USD. If Buffet had sold then, he would have earned 4.2 bln USD instead.

Above numbers however refer to simple buy-hold-sell strategy. And do not seem to take under consideration profits made on delivery deferments and lending silver. Unfortunately, we’re unable to conclude proportion of profit Further letters to investors lacked any additional information on the subject.

Disposal of Berkshire Hathaway’s silver inventories helped to establish SLV silver exchange traded fund, which was operational since 2006.

Mr. Buffet’s bet in silver validated white metal as a serious investment in the eyes of other big players. Curse of the Hunt Brothers had been lifted.

Mr. Buffett’s foresight aligned with the views of other influential figures. Bill Gates – known for having close personal relationship with Mr. Buffett, invested in Pan American Silver shortly after events described.

As chairman of NovaGold Resources, Thomas Kaplan was preparing to take his silver company public. announcement of Buffett’s investment coincided with this event, completely altering the landscape for Kaplan’s business.

Andrew Kilpatrick, a stockbroker in Birmingham, Alabama, who wrote ‘Of Permanent Value the Story of Warren Buffett’, said the following on Buffet’s silver deal:

Buffett's a long-term investor and usually takes a stake in something for five to 10 years. There are many investments that he's had for 25 years, so holding silver for a year is like a day-trade for him.

Hence, need to lay a question on who possibly was an author of strategy used in 1998? Was it Mr. Buffett or deceased in 2023 Mr. Munger? Maybe on this occasion Charlie Munger was to Warren Buffett, what Stanley Druckenmiller become to George Soros when they broke the Bank of England in 1992?